401k Calendar Year

401k Calendar Year. While it might sound simple, a year of service is often defined as 1,000 hours of service during the plan year. Contributions to individual retirement accounts can be made for the previous.

Eligibility to deduct the i.r.a. Contributions to individual retirement accounts can be made for the previous.

The 2023 401 (K) Contribution Limit For Employees Was $22,500.

The 401(k) contribution deadline is simple enough—it’s dec.

While It Might Sound Simple, A Year Of Service Is Often Defined As 1,000 Hours Of Service During The Plan Year.

It’s $27,000 for those age 50+.

For 2023, The Roth 401 (K) Contribution Limit Is $22,500.

Images References :

Source: www.independent401kadvisors.com

Source: www.independent401kadvisors.com

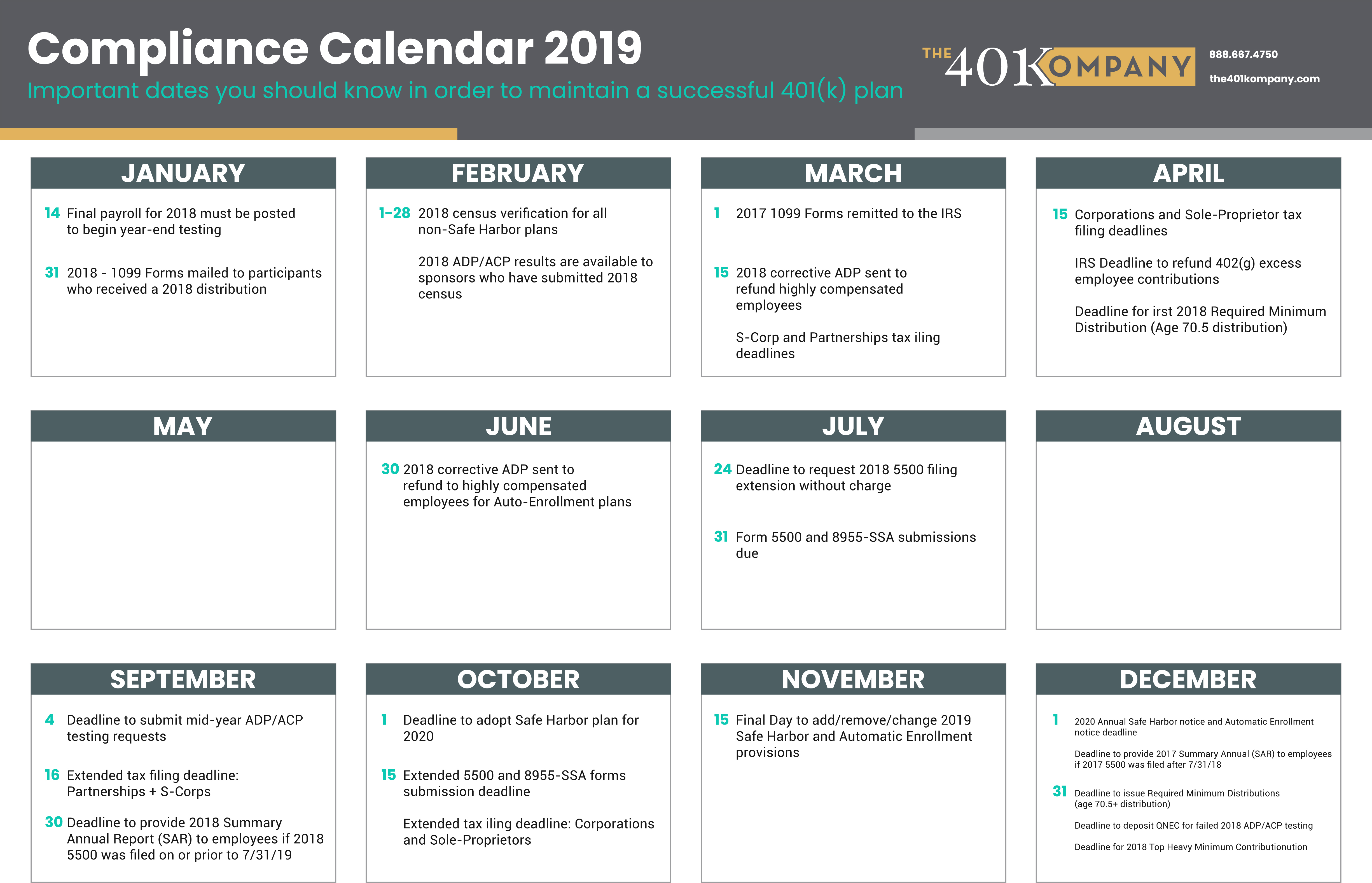

401(k) Compliance Calendar Independent 401(k), The 401 (k) contribution deadline is at the end of the calendar year. In 2023, the most you can contribute to a roth 401 (k) and contribute in pretax.

Source: the401kompany.com

Source: the401kompany.com

401(k) Calendar The 401(k)ompany, The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. In 2023, the most you can contribute to a roth 401 (k) and contribute in pretax.

Source: mungfali.com

Source: mungfali.com

Solo 401k Contribution Limits For 2020 & 2021 41C, Why should my 401 (k) plan use a calendar plan year? Contributions to individual retirement accounts can be made for the previous.

Source: www.independent401kadvisors.com

Source: www.independent401kadvisors.com

401(k) plan checklist Independent 401(k), 401 (k) contribution and plan establishment deadlines vary based on if you are an employer, an employee, and/or are setting up your first 401 (k) plan. In fact, it could help workers keep as much as $5 billion of their own money each year related to one insurance product alone, according to the council of economic advisers.

Source: www.bestofficefiles.com

Source: www.bestofficefiles.com

8 Free 401K Planner Template Best Office Files, Do you need to establish a solo 401(k) plan and make contributions before the end of the calendar year? In this scenario, a participant could only defer up to the maximum of $19,000 (or $25,000 if over age 50) during calendar year 2019 even though there are portions of two different.

Source: 401kcalculator.net

Source: 401kcalculator.net

Important ages for retirement savings, benefits and withdrawals 401k, Birthdays, wedding anniversaries, and 401 (k) plan compliance deadlines. To deduct the employer contributions made to your 401(k) plan for a given year, you must deposit them no later than the due date (including extensions) of your federal tax return.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

401k By Age PreTax Savings Goals For The Best Retirement, The 401 (k) contribution deadline is at the end of the calendar year. Your 401 (k) will contribute.

Source: www.fortunebuilders.com

Source: www.fortunebuilders.com

What Is A 401(k) Retirement Plan? A Beginner's Guide FortuneBuilders, This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a.; So with the 2023 annual limit of $21,240, the monthly limit is $1,770.

Source: www.zenefits.com

Source: www.zenefits.com

401(k) FAQs The Big List for 2021 Workest, Keep reading for important deadlines associated with your 401 (k) plan. The 2023 401 (k) contribution limit for employees was $22,500.

Source: apennylearned.com

Source: apennylearned.com

The Ultimate Guide To The 401k A Penny Learned, This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a.; Birthdays, wedding anniversaries, and 401 (k) plan compliance deadlines.

In Retirement At Your Current Savings Rate.

Do you need to establish a solo 401(k) plan and make contributions before the end of the calendar year?

However, The Irs Allows Contributions To Ira Accounts Up To The Tax Filing Deadline.

It’s $27,000 for those age 50+.